We are delighted to announce that Innova Limited (Innova) has received approval from the Capital Markets Authority (CMA) to conduct testing of our innovative cloud-based data analytics platform. This approval is a significant milestone for us, as it allows us to demonstrate the capabilities and potential impact of our platform in the financial industry.

The CMA Regulatory Sandbox is a program provided by the Capital Markets Authority (CMA) that allows fintech companies to test innovative solutions in a controlled environment, ensuring compliance with regulatory requirements.

By participating in the sandbox program, Innova gains valuable insights and guidance from the CMA, enabling us to align our solutions with industry regulations and best practices.

Being admitted to the CMA Regulatory Sandbox demonstrates Innova's commitment to compliance and regulatory standards while showcasing our innovative software solutions. This admission provides us with an opportunity to further validate and refine our offerings in collaboration with the regulatory authorities.

By participating in the sandbox program, Innova gains valuable insights and guidance from the CMA, enabling us to align our solutions with industry regulations and best practices. It also provides us with a platform to showcase our capabilities to potential clients and stakeholders, reinforcing our position as a trusted and compliant fintech company.Admission to the CMA Regulatory Sandbox is a testament to our commitment to delivering practical and functional solutions that address the unique challenges of the financial and capital markets in Africa. It signifies our readiness to navigate regulatory requirements and work closely with regulatory bodies to drive innovation and shape the future of the industry.

The approval from the CMA comes with a testing period of 12 months, during which we will collaborate closely with our clients and stakeholders to validate the effectiveness and reliability of our platform. This testing phase allows us to gather feedback, fine-tune our offerings, and ensure compliance with regulatory requirements.

Our data analytics platform has been specifically designed to cater to the needs of a wide range of stakeholders, including Investors, Fund Managers, Custodian Banks, Actuaries, Pension Administrators, and Regulators. By harnessing the power of cloud technology, our platform enables efficient data analysis, insightful reporting, and informed decision-making.

Being admitted to the CMA Regulatory Sandbox demonstrates Innova's commitment to compliance and regulatory standards while showcasing our innovative software solutions. This admission provides us with an opportunity to further validate and refine our offerings in collaboration with the regulatory authorities.

We are excited about the opportunities this approval brings. It allows us to showcase the capabilities of our cloud-based data analytics platform and demonstrate its potential to revolutionize the way financial professionals analyze and interpret data. We are confident that our platform will enable investors, fund managers, custodian banks, actuaries, pension administrators, and regulators to make more informed decisions and enhance their operational efficiency.

We extend our gratitude to the Capital Markets Authority for their recognition and support. This approval reaffirms our commitment to delivering innovative and practical solutions that address the unique challenges of the financial industry. We look forward to an impactful testing period and the opportunity to contribute to the advancement of the financial sector in Kenya.

Our latest news

NEWS AND FUN FACTS

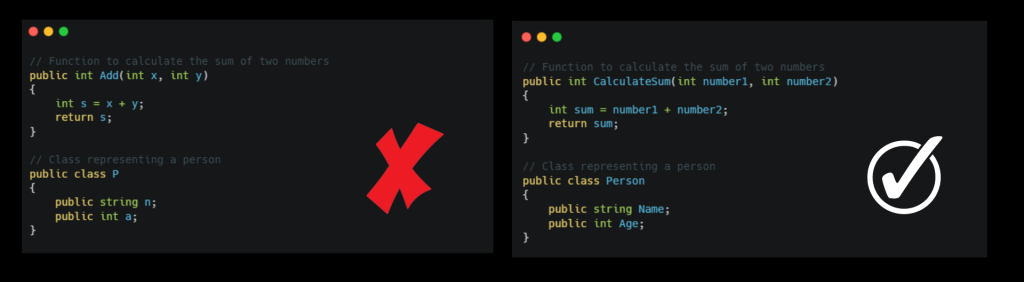

The Art of Writing Clean and Maintainable Code

Writing clean and maintainable code is a critical aspect of software development. It not only ensures that the applicati ...

Innova Admitted to the CMA Regulatory Sandbox

We are delighted to announce that Innova Limited (Innova) has received approval from the Capital Markets Authority (CMA) ...

Innova's Conrad Akunga Awarded at the 2016 Busines ...

Innova Limited takes great pride in announcing that Conrad Akunga, our esteemed Co-Founder and Director of Research & Pr ...